Hospitals, Financial institutions and magical thinking

NOV 15, 2023

Alternative Medicine takes us back a thousand years.

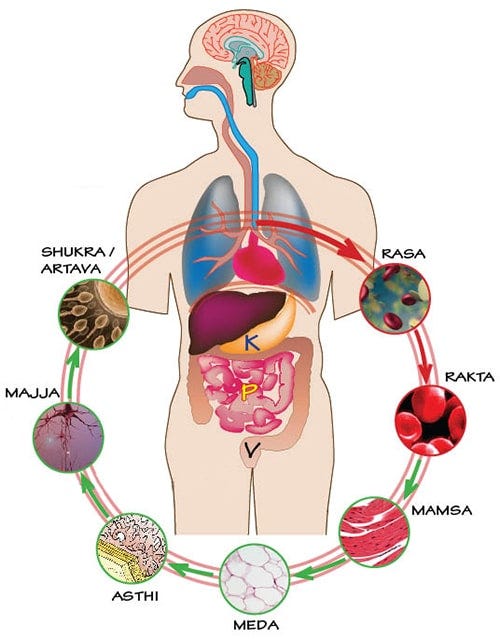

In the last couple of years I have noticed that respected hospitals, including such trusted names like the Mayo Clinic and John Hopkins are offering treatments that have long been known to be pseudoscience. These “treatments” include Ayurveda, Reiki and Homeopathy. People continue to believe. There is no rational reason why any of them work (and they don’t.) To explain how they work they have to go straight to magical thinking, where the cause and effect are created by our need to find patterns and answers in all types of situations. None of these practices can beat placebos in trials done outside of the Alt medicine complex. I was amazed that this has happened and now there are more than 70 medical schools who buy into this and have created training courses in voodoo. Voodoo being the catch all word for this stuff.

Subscribed

Alternative therapies in academic medical centers compromise evidence-based patient care, April 2020, NIH

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7108910/

A lot of this comes down to money. Think of the profits made charging people $150.00 to spend 30 minutes to be with a $30,000 a year “Reiki Master.” The demand is too great for them to resist. This is where our doctors are supposed to step in and be adults and clear thinkers. But these young Doctors cut their teeth on believing children can be “born in the wrong body.” These aren’t our landscape guy or plumber believing nonsense. It’s the people we trust to uh,…not die?

Alternative medicine becomes a lucrative business for top hospitals in the US

https://www.fiercehealthcare.com/healthcare/alternative-medicine-becomes-a-lucrative-business-for-u-s-top-hospitals

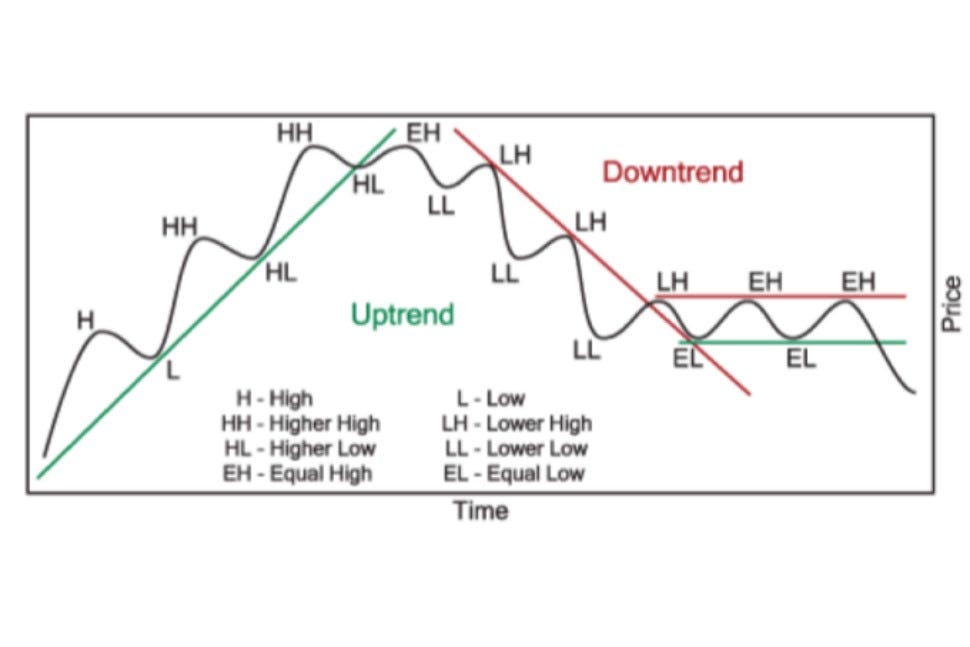

Technical Analysis, the Reiki of investing

For decades people have been trying to read the future by gazing at charts of various kinds. They look for patterns that may “look like candlesticks…or teacups.” Technical Analysis (hereafter TA) is taught in some of the best business schools including Harvard, Wharton School of Business, UCLA and many more. To their credit, some schools have dropped TA classes, but it is ingrained in the system of the market, like chiropractic is to medicine.

TA assigns predictions based on looking at Fibonacci levels, Elliott wave theory, and many more while also looking for a wide assortment of shapes.

Patterns commonly looked for are Fibonacci levels, Regression channels, Renko charts, point and finger charts, and Heikin Ashi. Less used but a serious part of TA are the ever popular piercing line/dark cloud cover, Dragon Fly doji, Long legged Doji, and Harami. They do this all with a straight face. Just like the New Age medical field.

This is mostly from Chapter 6 of my book, Mindful Money (Amazon) titled “Technical analysis-and other things that don’t work”

It is still mind blowing that the main tenet of TA is to tell us when to buy a stock and when to sell. They rely on buy or sell signals. You commonly hear that “this stock is ready to break out,” or this stock may be feeling resistance. Here is an example of the logic:

TA practitioners think that a stock has to reach a “breakout” point, which is some price well above the current price before it becomes a “buy.”. An example from yesterday is Cardinal Health (CAH) a stock which I follow. It was $69.60 in April. It had been growing at a good clip, paid a dividend and was not overvalued IMO. It’s “breakout price,” the price the TA’s were waiting for was $95.10. Monday, it briefly hit the breakout price no doubt triggering buy orders all across the land. Then it went down to 90.51.

Breakouts are seen as an inflection point where TA says the stock is more apt to break out to a new unseen level. Is this based on earnings or sales? No. Just lines on a chart. If mutual funds used TA there would be funds that market themselves as TA funds. They aren’t any. If there were

Who knows how it will do? The fact remains that there are major brokerage houses sitting around looking for something to buy for you. Did you know that some may let great potential deals slip by while waiting for some imaginary breakout level? In the case of CAH the Voodoo collective passed on $69.60 in April while waiting to buy in at the $95.10 “breakout!” Doing so made them miss out on the 36% gain from April to November. What their charts didn’t tell them was to buy it at at $69.60!

Buying a stock is the same as buying into a company. Let’s say you and 2 associates were looking at a business to buy. Is there any chance, in your wildest imagination, would prompt them to say “we like the company a lot, but would like to know when to buy. After looking at profits, sales, debt, etc. our figures say that your company is worth $800,000, the same as your asking price.” However, after a lot of thought we feel it is wise to wait until the business is priced at $950,000. That is what our charts are telling us. This is a good proof that the whole TA “thing” is nonsense.

See you soon,

Craig Verdi

call or email to inquire about working with me. 208-559-6250 [email protected]

This article is not a recommendation for any security. Stocks are used for example purposes only.

Subscribe to The Tangled Web- (this article was posted earlier on Substack)

By Craig Verdi · Launched 2 months ago

The Tangled Web-Craig Verdi Why we make bad decisions. How we come to conclusions, and how we are lied to. The failure of logic, human nature in general, with a bent toward investing and social issues.

subscribe at substack.com/craigverdi

·