Craig Verdi- 11-22-2023

In 2014, Michael Lewis author of Moneyball and The Big Short wrote a book called Flash Boys. He should have quit while he was ahead. In Flash Boys he tries to make the case that high speed trading can make the market “rigged.” The story in the book covers one event in which a money manager from Canada discovered that some hedge funds had set up very high speed computers to create an edge in the price of stocks they bought. He created a work around for it, the SEC figured it out and it was done. But Lewis, was on dozens of interviews with the lasting message “the market is rigged.”

Is the market “rigged?” The short answer is NO, the market is not rigged. We have the most efficient market in the history of the planet. If Warren Buffet buys a share of Coke (KO) and I buy a share of KO, we get the exact same deal. There is no advantage for the rich guy.

Let’s look at an example of “rigging.”

You are selling your house for $875,000. You get two offers. The first offer is for full price. It is contingent on the buyer closing on his current house and his bank approving a loan. The second offer is for $865,000 in the form of a cashier’s check; you can close today. Which one is more attractive? If you picked offer number one that would be unusual. Most of us would take the sure deal with cash in hand.

Question: Was your house deal rigged in favor of the cash rich buyer? Did he have the advantage because he was “rich?” Yes. Well, guess what? Anyone in America or wherever who has lots of capital has an advantage. They get some minor discounts in various forms. They can buy the technology that we can’t even think about. So they gain a very slight advantage.

Thanks for reading The Tangled Web! Subscribe for free to receive new posts and support my work.

Subscribed

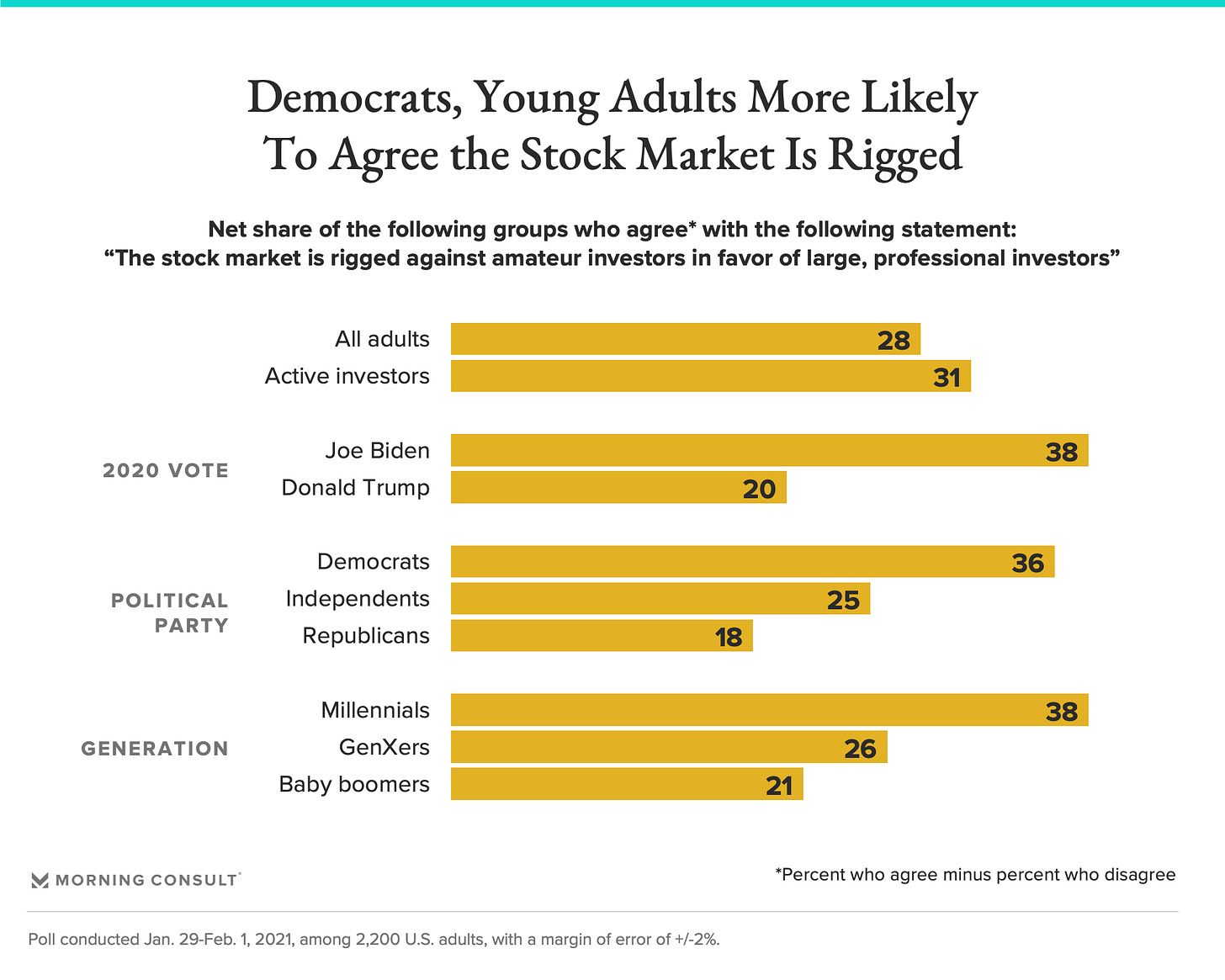

Why are the poll results below so easy to guess?

You can say or think it is rigged, but it really will have almost zero effect on the price of your portfolio when you retire or need it for one of life’s big events. Top excuses people use to not invest. These are mental and behavioral issues not economic ones! Some costly thoughts:

1. “The market is rigged,” is an excuse for those that will be broke at retirement. Their lifelong refusal to invest in the company 401k or to open an IRA of course, is the cause. This excuse leads a long list of nonsense reasons not to invest.

2. The Fed controls the market.

3. Only the rich, with inside information, make money on stocks.

4. My Grandpa or my Dad told me to “never invest in stocks!” or My Grandpa/ Dad lost “all their money” in stocks. You realize that is impossible unless, of course, they had it all in one stock like Enron.

5. “I don’t have enough money to invest in stocks.” Yes you do. What is the alternative?

6. The world will end before I get that old. I remember people telling me that 30 plus years ago. God is going to save us. Not from poverty. He gave you a brain for that. Some of this comes from a skewed view of the Bible. The Bible is repetitive in it’s admonition to not place dates on future events.

8. “I am not smart enough.” You may have a point here.

10. “I don’t want to retire.” This can be valid. But it can also be the refrain of someone who can’t retire.

I am afraid our youth and in general the country have moved more to an external locus of control which means they believe life’s events and circumstances are caused by forces outside of their control. This is generally considered as an unhealthy way to think. Democrats can take a lot of credit for this with the “everyone is a victim,” strategy. This has happened in a very short period of time, the last 10-20 years.

Thanks for reading The Tangled Web! Subscribe for free to receive new posts and support my work.

.An “internal locus of control,” means that a person believes circumstances, problems and victories are not luck but that we have been responsible for creating these events. This is healthy, empowering way to think.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Benjamin Graham came up with this idea, but Warren Buffet shortened it in his letter to Berkshire Hathaway shareholders,“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Sounds a bit confusing but is a smart observation. In the short term, stock prices follow psychology. For instance, when enthusiasm is high people buy stocks. They “vote” by buying a stock. But in the long run, the market will always weigh the value of a company as expressed in growth of earnings and dividends. It will revert to its intrinsic value.

People who believe the market is rigged will live with that thought as reality. For them they will live in a world where the market is rigged.

See you soon,

Craig

This article originally was published at craigverdi.com